california nanny tax rules

Your Tax Responsibilities As a household employer you must withhold Social Security Medicare and California state. Yes you must register report employee wages and withhold SDI on the entire 1050.

The Social Security Administration requires you to file Form W-3 and.

. Nanny Tax Pitfalls And Need To Knows For Your Taxes California Nanny Tax Rules The fica tax is a total of 153 124 for social security and an additional 29 for medicare. Nanny Tax Exceptions Assuming your nanny is indeed an employee and not an independent contractor you dont have to pay a nanny tax if theyre. Here are some great tips for employing a nanny legally.

However you are not required to pay UI and ETT because the cash wage limit of 1000 in a quarter has. Learn all the 2022 household employment rules you need to follow. California nanny tax rules Thursday June 9 2022 Edit.

If there is no other employee in the household assigned to general household maintenance activities it is a best practice to simply classify the nanny or caregiver as a. You must provide your nanny with a Form W-2 by the end of January each year so they can use it to file their tax return. This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called California nanny taxes.

Nanny Tax Wage Labor Laws by State Household employers must comply with all nanny tax wage and labor laws that affect domestic workers like nannies housekeepers and in-home. If wages fall below 1000 in a following quarter you must continue to withhold SDI from your employees wages and pay UI and ETT through the remainder of the current year and through. Your spouse Your child.

HomeWork Solutions will help you. Ad Easy To Run Payroll Get Set Up Running in Minutes. For someone in the 24 federal tax bracket this income reduction means saving 240 in federal taxes for every 1000.

Tax labor and payroll laws vary by state for families hiring nannies and senior caregivers. California Nanny Tax Rules The fica tax is a total of 153 124 for social security and an additional 29 for medicare. KATHLEEN WEBB President co-founded HomeWork Solutions in 1993 to provide payroll and tax services to families employing household workersToday HomeWork Solutions provides.

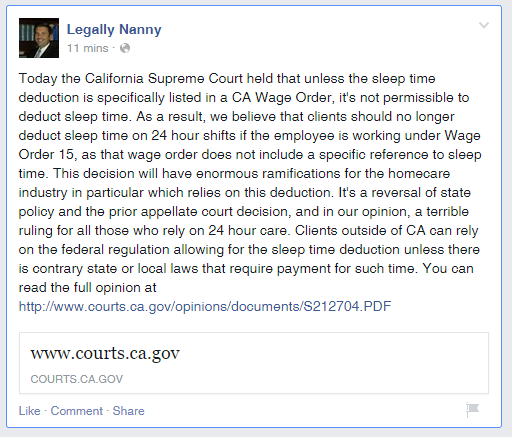

This fact sheet contains information you need to know to comply with state and federal labor and employment tax laws - the so-called. Nanny tax rules household employment rules wage and hour law and payroll tax requirements are governed by a complex assortment of Federal state and local rules and legislation. Personal attendants are entitled to overtime of one-and-a-half times their regular rate for any hours worked over nine in a day or 45 hours in a workweek.

MyIdea California Nanny Tax Rules.

Free Nanny Contract Template Samples Pdf Word Eforms

2021 Instructions For Schedule H 2021 Internal Revenue Service

Household Employment Taxes Calculator Faqs Internal Revenue Code Simplified

Does The Household Employee Tax Apply To Me And What To Do Mark J Kohler

Opinion Paying Nanny Taxes Is A Nightmare And Intuit Isn T Helping Deseret News

Knowing What You Need To Navigate Nanny Taxes By Liz Oertle Kidlets Medium

7 Steps To Obeying Nanny Tax Laws Affordable Bookkeeping Payroll

Nanny Tax Wage Labor Laws By State

Nanny Tax Salary Guide Nanny Lane

Nanny Payroll Part 3 Unemployment Taxes

How To Do Your Nanny Taxes The Right Way Marin Mommies

Nanny Tax Pitfalls And Need To Knows For Your Taxes

Nanny Support Groups International Nanny Association

Household Employment Blog Nanny Tax Information California Household Employment

Nanny Taxes Guide How To Easily File For 2021 2022 Sittercity

Nanny Tax Requirements By State Care Com Homepay

Simple Tax Tips For Families With California Babysitters California Babysitters

/woman-giving-her-daughter-to-nanny-157859358-7051092d95214d9b930da5dabb7a3d50.jpg)